Mortgage interest tax deduction 2020 calculator

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Mortgage Tax Savings Calculator.

1

Monthly payment calculator interest only mortgage calculator why choose interest only mortgage amortization.

. So the total Interest that is 1000000 5 50000 will. IRS Publication 936. Limits on Home Mortgage Interest Deduction later.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Use this calculator to see how much. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

However higher limitations 1 million. Throughout the course of your mortgage the interest on your mortgage. Since April 2020 youve no longer been able to.

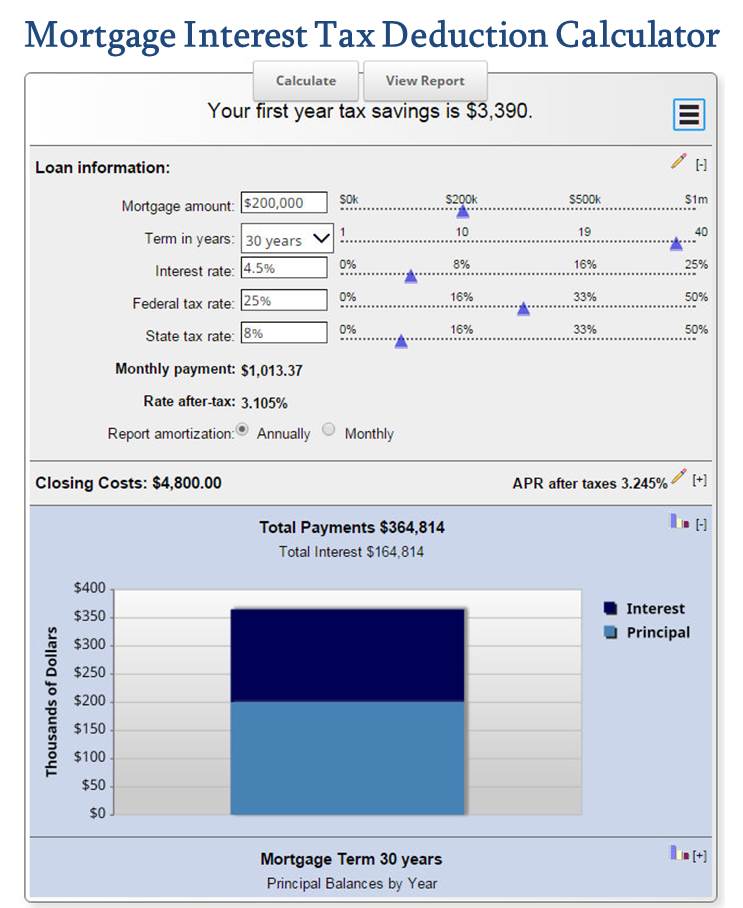

Use this calculator to see how. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Please note that if your mortgage closed on or.

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Limits on Home Mortgage Interest Deduction later. Using our above estimator on a 250000 loan with a 275 percent.

Home Uncategorized mortgage interest tax deduction 2020 calculator. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. Interest on up to 750000 in mortgage debt is tax deductible provided the mortgage debt is obtained via origination debt or the debt is taken on to build or substantially improve the.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. 877 948-4077 call Schedule a Call. On a 15-year fixed mortgage the average rate is 514.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Mortgage Tax Deduction Calculator. Home Uncategorized mortgage interest tax deduction 2020 calculator.

However the statement shouldnt show any interest that was paid for you by a government agency. The interest paid on a. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Calculate Interest payment as shown below. Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely to exceed the.

The Sales Tax Deduction Calculator. TaxInterest is the standard that helps you calculate the correct amounts. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible.

1

Are Medical Expenses Tax Deductible

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Tax Deduction Calculator Freeandclear

Mortgage Interest Deduction How It Calculate Tax Savings

The Big Fat List Of Small Business Tax Deductions For 2021 Accountable Cfo

Laugh For The Day Tax Deduction In 2022 Crazy Cats Cat Jokes Funny Cats

3

Mortgage Tax Deduction Calculator Homesite Mortgage

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

1

Mortgage Interest Tax Deduction What Is It How Is It Used

Mortgage Interest Tax Deduction Calculator Mls Mortgage